Offline processing

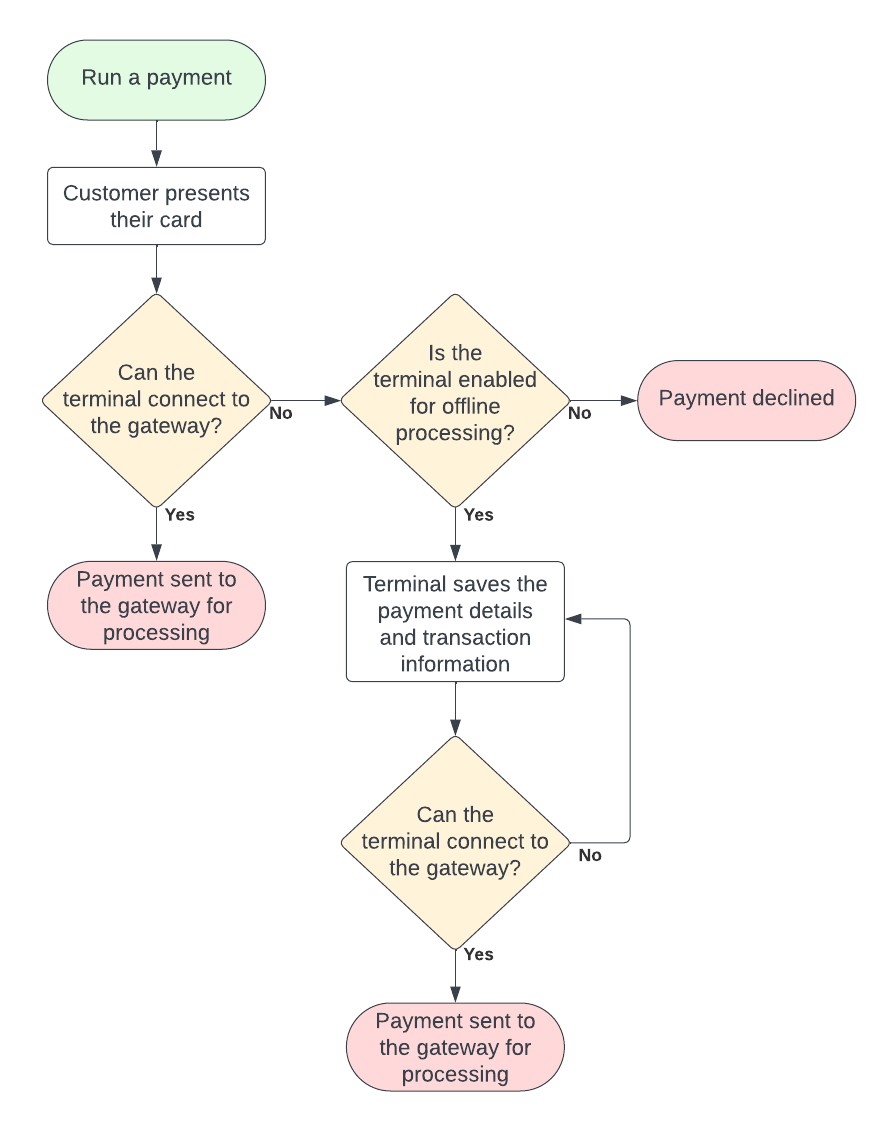

If offline processing is enabled on a terminal, the terminal can still accept payments when it can’t connect to the gateway, for example, if the terminal loses internet connection.

When a merchant runs a payment and the terminal is offline, the terminal saves the payment details and information about the transaction. When the terminal connects to the gateway, it sends the payment details to the gateway to process the payment.

Note: Offline processing should be used only temporarily as there are risks to the merchant. For more information about the risks, see risks of offline processing.

How it works

Risks of offline processing

If the terminal can’t connect to the gateway, the gateway can’t authorize the payment. There are many risks involved with accepting an unauthorized payment including:

- Customer could use a fraudulent card.

- Customer might not have the funds to pay.

- Customer could claim that they didn’t authorize the payment and raise a chargeback.

Important: The merchant is liable for funds that they can’t capture from a cardholder’s account and chargebacks arising from offline payments.