- Introduction to the knowledge base

- Glossary

- Basic Concepts

- Tap to Pay on iPhone Draft

- Card Payments

- Events

3-D Secure

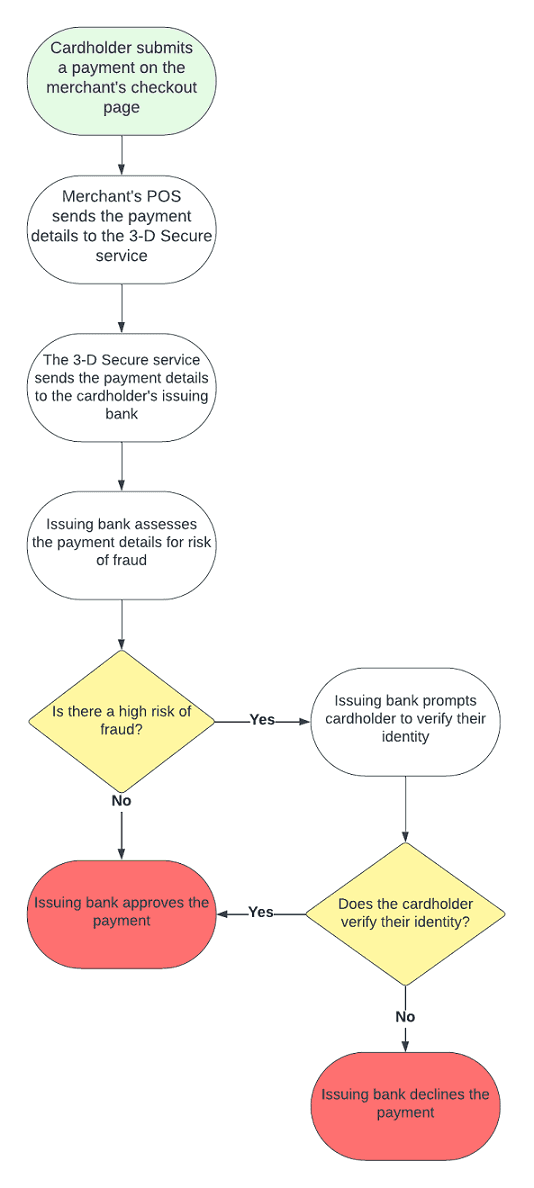

Issuing banks use 3-D Secure to help prevent fraud in e-commerce payments. When a merchant runs an e-commerce payment, they can send details about the payment to the 3-D Secure service. The 3-D Secure service then sends these details to the issuing bank to assess the risk of fraud for the payment. If the risk of fraud is too high, the issuing bank then asks the cardholder to verify their identity. For example, if a cardholder wants to buy an expensive item from an online store, the issuing bank prompts the cardholder to log in to their banking app to verify their identity. 3-D Secure is also known as:- Visa Secure

- Verified by Visa

- Mastercard identity check

- Mastercard SecureCode

- American Express Safekey